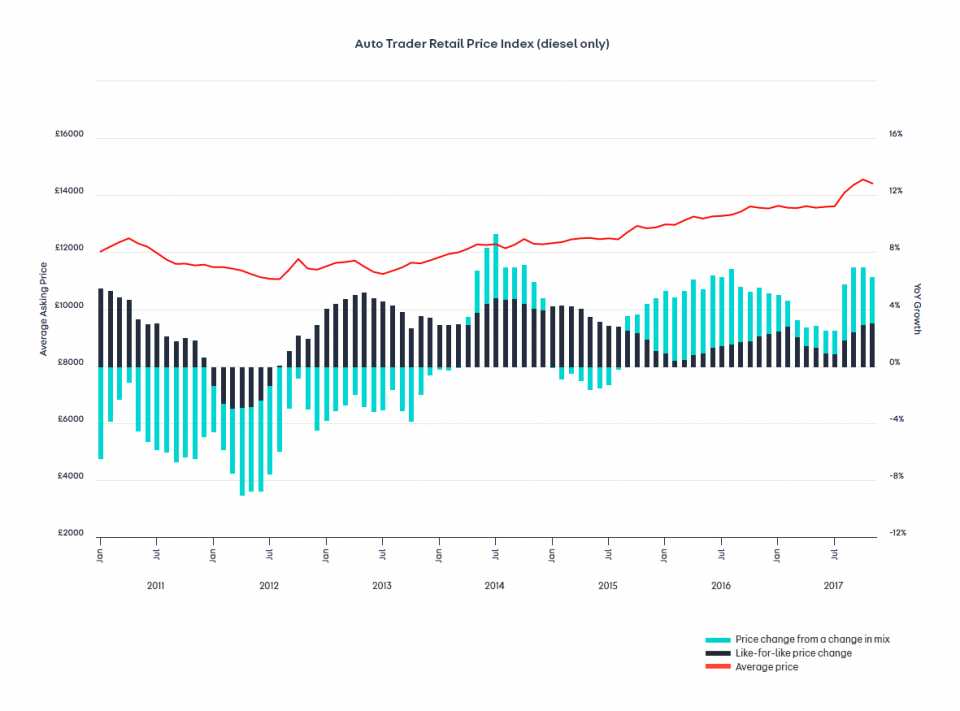

Used-diesel prices decline in November, but are up year-on-year

According to the latest figures from the Auto Trader Retail Price Index, in November, the average price of a used diesel saw a monthly decline, falling £143 on the previous month, to £14,412.

However, on a like-for-like-basis, the fuel type recorded an annual increase of three per cent.

In contrast, the average price of a used petrol car increased £55 month-on-month, reaching £10,342. On a like-for-like basis, this equates to a year-on-year increase of 11 per cent.

Auto Trader’s data also reveals that diesel is still the most searched for fuel type.

Since November 2016, the number of searches for diesel cars has steadily declined in line with negative commentary; falling from 71 per cent to a low of 54 per cent in May 2017. However, since then this decline has started to reverse, with diesel searches gradually rising to 56 per cent of all fuel related searches in September. This figure remains flat, accounting for 55 per cent of all fuel searches in October and November respectively.

Searches of petrol represented 41 per cent of all fuel searches in November, remaining consistent from October when they accounted for 40 per cent.

Commenting on the findings, Karolina Edwards-Smajda, Auto Trader’s Retailer and Consumer Product Director, said: “The negative rhetoric surrounding diesel, which has been fuelled by the government’s recent announcements is undoubtedly contributing to the decline in new and used car sales and has impacted used car prices in November.

“Although used diesels have been showing much greater resilience, with their value continuing to increase year-on-year, as well as remaining the most searched for fuel type on our marketplace, the Index does show a small month-on-month decline for the first time in eight months. It’s too early to tell whether this is an emerging trend or not, so we will continue to monitor prices closely.”

The Auto Trader Retail Price Index combines and analyses data from c. 500,000 trade used car listings every day, as well as additional dealer forecourt and website data (OEM, fleet and leasing disposal prices, in addition to pricing data from over 3,000 car dealership websites and data from major auction houses across the UK), ensuring the Index is an accurate reflection of the live retail market.