An electric future needs big thinking and collaboration

What does an electric vehicle future look like and what needs to happen to facilitate it? The Renewable Energy Association (REA) sets out its vision for the pace of change in the electric vehicle market, consumer behaviour, and calls for companies to get involved in the development of an industry-led UK Charge Strategy

This government is serious about the decarbonisation of transport. From supporting the development of a British Battery Institute, introducing a plan to deliver electricity market flexibility reforms, and introducing higher mandates for renewable fuel, it is clear that key officials see the opportunity that a more electrified, lower-carbon transport fleet brings.

From many corners of industry and the public, however, we as an organisation encounter skepticism as to our views on the likely pace of change, particularly in regards to electric vehicles. Why would a renewable energy trade body even be getting involved in the electric vehicle sector? Both are pertinent and urgent issues, and ones that our new report EV Forward View seeks to address.

The pace of change

A quick survey of public policy in key manufacturing nations gives us a sense of the trends. While the UK and France have both confirmed that they will end the sale of new petrol and diesel cars and vans (without a battery element) by 2040, others are moving more quickly.

The government in the Netherlands has proposed mandating that all new cars sold from 2030 are emissions‑free. By 2030 every car sold in India will be electric, a date that the German government is also considering for their phase-out.

China’s “New Energy Vehicle” mandate, introduced this autumn, will ensure minimum new EV sales and has been called by one analyst as “probably the single most important piece of EV legislation in the world” (Colin McKerracher, Head of Advanced Transport at Bloomberg New Energy Finance).

The results are startling. Between 2010 and 2016 Bloomberg New Energy Finance (BNEF) estimates that battery pack production costs have fallen by 73 per cent. They expect costs to more than halve again by 2030. Beyond Tesla, a range of new entrants have entered the EV sector, ranging from Dyson (a new transport market entrant who has proposed creating their own EV from scratch) to established carmakers such as Volkswagen, who said that each of their models will be available as an electric version by 2030.

VW has estimated that as many as 40 Tesla‑sized “Gigafactories” for manufacturing batteries may be needed globally to meet EV demand by 2025. For context, Tesla’s first “Gigafactory” in Nevada is anticipated to produce more lithium-ion battery capacity in 2020 than was produced by all manufacturers globally in 2013. Already Tesla is in talks with the Chinese to develop a battery factory there, and they are certainly not the only company developing such facilities.

The EV Forward View report also lays out other key views, such as our belief that most carmakers have already stopped further R&D on diesel cars as of this year and that it is possible that 50 per cent of new car and van sales will be fully electric or plug-in hybrids in the UK by 2025. The Boston Consulting Group recently released a forecast that echoes our vision for the pace of change, estimating that half of the global car fleet would be electric (in some form, ranging from hybrids to fully battery electric) by 2030.

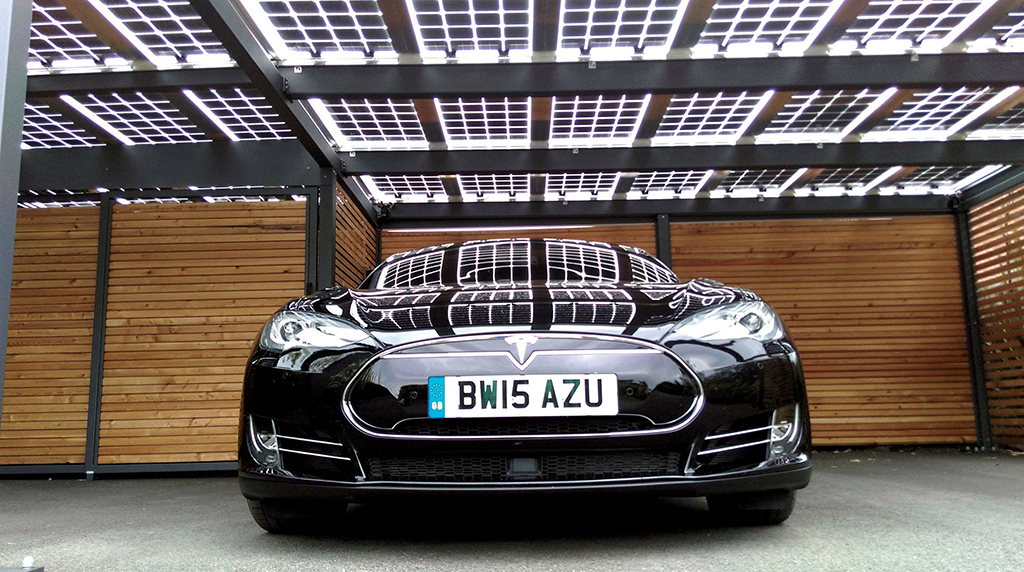

In terms of consumer behaviour, we anticipate consumers will be able to choose between multiple charging tariffs depending on the needed speed of recharge (different rates depending on if you are heading to Ikea for the afternoon or just popping into Tesco’s for eggs). Onsite renewables and energy storage technologies are going to be essential to reducing grid stress at such charge points. With 40 per cent of homes not having access to on-street parking many of these consumers will rely on public charging, potentially at work and supplemented by facilities at supermarkets, public car parks, and charging hubs that may start to replace petrol stations.

Policy and technology developments all considered it seems that the direction of travel, so to speak, is clear. Now what’s needed is ambitious public policy and coordinated industry activity to ensure that the UK wins a significant share of this future high-value manufacturing capacity.

Government policy

The UK is well-poised to grow its manufacturing base given its existing position as a clean tech leader and as Europe’s fourth largest vehicle manufacturer. We believe building batteries domestically will be key for securing future electric vehicle manufacturing, which is in line with the rationale of the recent R&D funding for advanced battery materials and vehicle-to-grid technology.

The Alternative Fuels Infrastructure Directive, a piece of legislation that is being brought over from the EU, will make charging more straightforward for the public as it requires ad-hoc access to newly-installed public charge points from November.

The Automated and Electric Vehicle Bill making its way through Parliament right now will give government the powers to impose requirements on large fuel retailers and service area operators so as to provide EV charging facilities. It also empowers the government to introduce minimum requirements on the “smartness” of charge points.

Parliamentarians are increasingly compelled by this topic as well. The REA is working with the Rt Hon Cheryl Gillan MP (Con) to develop the All-Party Parliamentary Group (APPG) on Electric and Autonomous Vehicles, which will coordinate a range of events and activities for parliamentarians over the next twelve months with the aim of educating them with the most up-to-date facts. The debate around these issues is not just taking place in industry circles – the EV Forward View and several of its key recommendations were mentioned in the House of Commons chamber this October.

Industry Activity

All this said, what is the role for a renewable energy and clean tech trade association in moving the market forward? In summary, the barriers between sectors are starting to break down. Power technologies such as solar and energy storage will be key to reducing both costs and grid stress in this new system.

Reforms laid out in the Smart Systems and Flexibility Plan, which the REA has long advocated for and worked on, will have significant impacts on the ability to deliver time-of-use charging and to manage the new stresses the transmission grid will be subject to. Electrification is also not the only decarbonisation option for transport, and there will be an ongoing demand for lower carbon liquid and gaseous fuels in heavy vehicles, shipping and aviation.

Even during the transition to electrification we need a higher blend rate of renewables in our petrol (i.e. E10) in order to meet both decarbonisation and renewable energy targets. As a renewable energy trade body we are fighting the corner for both renewable fuels and for electric charging infrastructure that helps with the integration of increasing amounts of intermittent renewable power generation.

Another benefit is that we can see the larger picture around how the power market will evolve. A report released at COP23 in Bonn by Bloomberg New Energy Finance, commissioned by Eaton in partnership with the REA, forecasts that if market drivers purely drove deployment at least 63 per cent of the UK’s power would be generated from renewables by 2040. Variable wind and solar generation mean that there will be a key role for smart charging and vehicle-to-grid technology to maintain balance on the system.

As a trade body, we hope to develop positions on a range of key topics, ranging from interoperability, the need for three‑phase power in new homes, and minimum power specifications for new commercial buildings.

We are developing helpful documents to help companies interested in this emerging sector move into it. Crucially, we are also developing a UK Charge Strategy, an industry vision for what actions the public and private sectors need to take in the coming years, and are looking for a wide range of companies to input into it.

The benefits are clear and the window of opportunity is here, right now. We need cross-sector collaboration and big thinking, and call for your input and involvement.